Crowded World of Crowd Funding

Over the last few years, crowdfunding has become an increasingly popular option worldwide for both entrepreneurs and investors. Crowdfunding is a term dealing with the process of raising funds from anyone or specifically from a group (crowd) of individuals to be invested it in a new product or service idea.

The process of crowdfunding has provided entrepreneurs with an avenue to actualize their innovative ideas by getting startup funds.

Definition of Crowdfunding

Getting deeper into the crowd-funding proposition, it is simply a way in which small portions of capital is gathered from a group of individuals or a large number of individuals, with the aim to finance a whole new entrepreneurial journey. This process has become quite popular among the new generation entrepreneurs, because of the easy accessibility and reach through the modern communication medium of social media and the Internet. Some of the champions of crowd funding are websites like Kickstarter and Indiegogo, which help the budding entrepreneurs by aggregating funds from amongst its donor base. To date cumulatively they have raised USD13.6 billion as estimated in January 2018 and this figure is growing.

Essentially, crowdfunding platform provides the convenience in finding a new venture fund or obtaining an investment, for investors or entrepreneurs.

Brief History of Crowdfunding

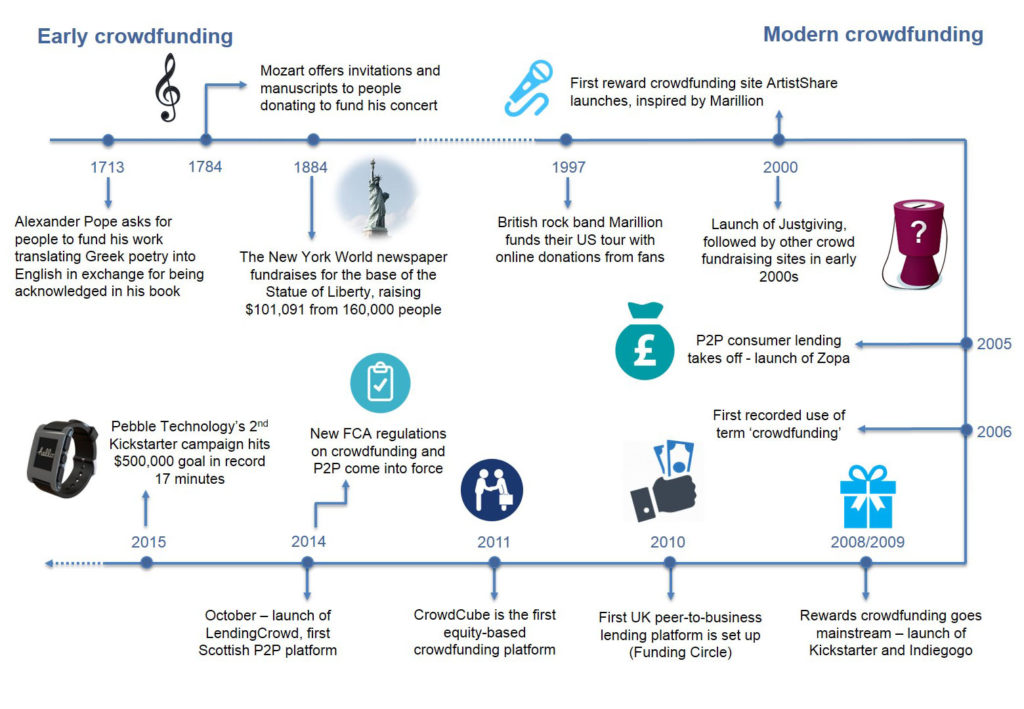

Historically, it was in the US the crowdfunding started dating back to the 19th century. Case in point is that in 1885, when government sources failed to provide funding to build a monumental base for the Statue of Liberty, a newspaper-led campaign attracted small donations from 160,000 donors to crowd fund it,

In the recent times, it was only in 1997 that the first very successful crowd funded project happened. It was initiated by a British rock band, who called in funds through the online medium required for their reunion tour. Most of their fans pooled in, and the financing proved extremely successful. However, it was in 2000 that the first crowdfunding website called ArtistShare came in to existence as a dedicated platform paving way for the modern leaders to follow.

With passage of time, crowdfunding slowly established itself as a popular choice among individuals to validate their business ideas, getting exposure, and garnering funds for them. The crowdfunding industry came in as a silent revolution. Its growth, in terms of raising funds, almost tripled in course of just two years from USD530 million in 2009 to USD1.5 billion in 2011, and since then it keeps on growing.

While a massive transition came in the aspect of crowdfunding with the launch of first crowd funding platform “The Fundable” platform in 2012. It created a whole new avenue for entrepreneurs to fund their ideas. It also created the new genre of equity crowdfunding. It was a huge innovation in itself. The tremendous success of Kickstarter and Indiegogo are a testament to the platform concept of crowdfunding.

In India, the term crowdfunding is not new. For example, at Malabar in Kerala, the century old tradition of PanamPayattu (crowdfunding) prevails at its crudest form, as a popular method to collect money for startup a business, construction of houses, marrying off daughters, sending children to abroad for job seeking or even higher-studies or other dire financial needs. Also, the places of worship are built using a large number of donations in many parts of India.

However, the concept of online crowdfunding is new to the country.

Types of online Crowdfunding

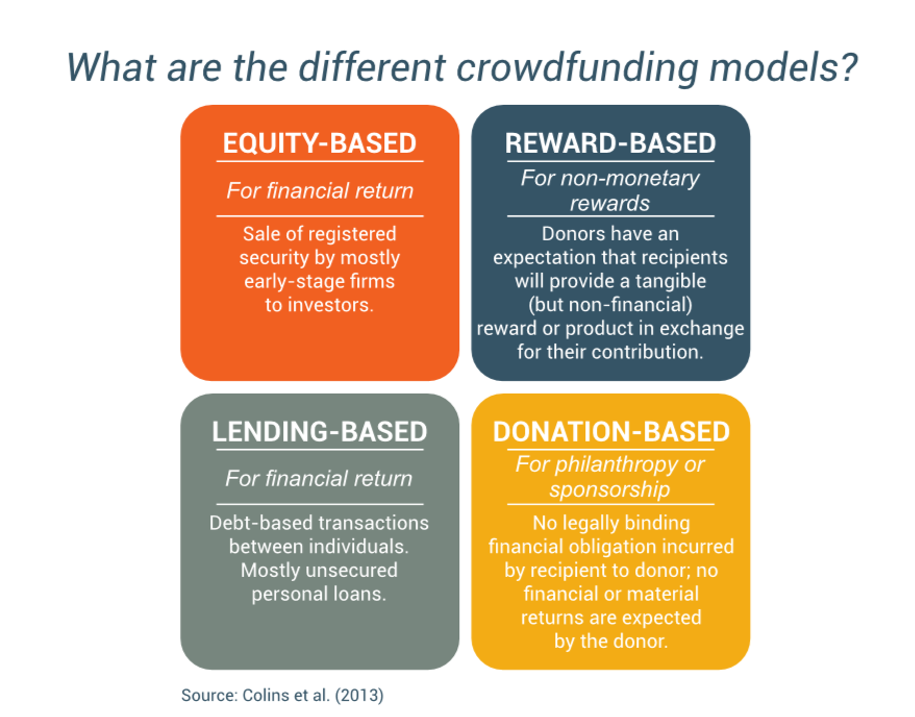

There are four distinct types of online Crowdfunding platforms. Each of which caters to different requirements and has its own pros and cons. These are broadly categorized as: rewards, equity, lending and donation.

- Reward based Crowdfunding- This type is the most common form of crowdfunding today. In this method, there are rewards set at varying levels of the execution, dealing with tangible products and maintains a face to face connection with the client.

- Equity Crowdfunding- Another popular form is equity crowdfunding. It revolves around the fact that an individual who funds can expect to receive a part of ownership in the organisation which is created through such fundraising. Hence, the company involved in the campaign sells a part of its equity to the members of the crowd who pitched in.

- Donation based Crowdfunding– Donation or charity based form of crowdfunding is the extreme efforts of individuals in collection to help causes involved with charity. In this form the most common causes for which fund is raised are social and environmental.

- Lending based Crowdfunding- Also known as debt based crowdfunding, this revolves around the fact of finding a group of individuals who will lend the money based on contract of repayment after passage of certain time.

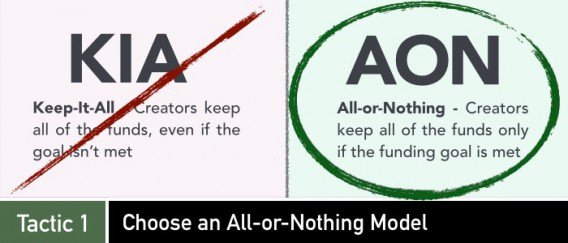

Reward based crowdfunding: All or Nothing (AoN) and Keep it All (KiA)

All or Nothing is a form of fundraising in which the set objective is to draw a sum only and only if the desired amount of fund is raised or exceeded in given time frame. Whereas Keep It All is a form where the whole amount that is raised is kept without regard to the set fundraised target.

Generally, going by experience, campaigns following the Keep It All form has much more difficulty in reaching their goal because potential funders are worried about they achieving the goal on partial fundraise. Whereas, in All Or Nothing the fundraising goal is focused on embarking on project only if the set target is raised in a finite time as funders believe they are more likely to achieve their goal.

Investors and Crowd-funding!

Among the hundreds of projects launched based on crowd-funding, many of those are based on rewards mean that the investors themselves get the first chance to use product or services coming out of such startup. For example, a drone camera startup promised each investor in lieu of $600 one such devise ahead of general public.

On the other hand, equity based crowd-funding is subsequently making a great progress now, the reason being it allows the entrepreneurs to generate revenue through their products and services while still being in the control of the investors in the venture. As this aspect offers the investors an equity position, the equity based crowd-funding is considered to be a much more secure form of financing, and in the US is regulated by Securities & Exchange Commission (SEC).

Equity Crowdfunding and its potential

Equity Crowdfunding: To get a business off the ground or to provide it with capital to really grow, entrepreneurs have typically turned to outside investors. In this scenario, they sell a part of the equity of their business to an investor/s in return for their capital. Crowdfunding has its own version of this type of financing: equity crowdfunding. In this model, investors can invest as little as $500 sometimes to buy a small share in a business. Companies like AngelList, OurCrowd, Seedrs, and others are the leaders in this space.

Some of the benefits of Equity Crowdfunding are:

- Larger amounts of money: When compared to other forms of crowdfunding, equity crowdfunding has the potential to raise larger sums of money. While that doesn’t always happen, the ticket size that investors need to subscribe are much larger than crowdfunding transactions seen in other forms like reward-based crowdfunding.

- One customer/investor: The investors quickly become a group of people dedicated to making the venture successful and the entrepreneurs can rely on their crowd of investors for feedback, ideas during the early stage. As the venture moves forward, the investors are more likely to invest in future ventures.

- Peer to Peer (P2P): Lending based crowdfunding allows entrepreneurs to raise funds in the form of loans that they will pay back to the lenders over a pre-determined timeline with a set interest rate.

Lending campaigns tend to take place over a shorter time span of around five weeks and works well for entrepreneurs who don’t want to give up equity in their startup immediately.

The top 5 Crowdfunded business campaigns

| S.no | Startup Venture | Platform | Amount Raised | Time span |

| 1 | The Pebble E-Paper Watch | Kikstarter | $10.2 million | 37 days |

| 2 | Ouya – an open-source gaming console | Kickstarter | $8.5 million | 29 days |

| 3 | Pono Music – innovative listening experience | Kickstarter | $8.5 million | 30 days |

| 4 | Bitvore – data analysis and monitoring | Fundable | $4,5 million | 30 days |

| 5 | The Dash- first smart in-ear headphones | Kickstarter | $3,4 million | 45 days |

Kickstarter is the leader crowdfunding platform. Founded in 2009 in New York, it has funded more than 126,000 projects to date and raised more than $ 3 billion. It only offers crowdfunding by donation and has 13 categories: films, music, technology, fashion … It brings together a community of 13 million financiers around the world. The US platform charges a commission of 5% on projects and the average success rate is 35.8% in early 2017.

Crowdfunding in India

Crowdfunding is a very dynamic market in India. The crowdfunding paradigm has accelerated its speed and we see formal and professional structures in this space. The numbers are increasing year by year. Some young Indian entrepreneurs have created successful peer to peer (P2P) lending platform and equity crowdfunding platforms. The P2P lending model contributes to more than 70 percent of the total crowdfunding funding volume. In India, P2P lending model hold great potential to cause disruption in the banking sector. Seeing the sudden growth in the lending startups in India, RBI (Reserve Bank of India) has recently regulated the P2P lenders as non-banking financial companies (NBFCs).

Some of India’s top crowdfunding platforms are namely Bitgiving, Catapooolt, Crowdera, DreamWallets, Faircent, FuelADream, FundDreamsIndia, Ignite Intent, Impact Guru, Ketto and the list is growing day by day.

However, crowdfunding in India is largely limited to donations and loans, because SEBI (Securities & Exchange Board of India) believes that most Indian lack the adequate knowledge of proper investing patterns and they require a disciplined knowledge about the proper functioning of crowd funding of equity in startups.

Conclusion

Therefore, the whole financial method of funding a project in context to modest contributions from a group of individuals gives life to an idea much more easily than seeking for sum of a substantial amount from a single investor or two. This has been proven in India as well, as the total transaction value on various crowdfunding platforms aggregated to USD8 million by Jan 2018. It is projected to grow on a CAGR of 28% during next 5 years.

To sum up with a quote of Ethan Mollick, a professor at Wharton very truly stated “the unique value of crowdfunding is not money, it is community”.

Reference Links:

- https://www.investopedia.com/terms/c/crowdfunding.asp

- https://www.fundable.com/crowdfunding101/history-of-crowdfunding

- https://www.forbes.com/sites/wilschroter/2014/04/16/top-10-business-crowdfunding-campaigns-of-all-time/#5f31fcd83e9f

- http://www.zdnet.com/pictures/10-fascinating-tech-projects-that-crowdfunding-has-made-possible/2/

- https://milaap.org/stories/how-does-equity-crowdfunding-work

- https://community.ulule.com/topics/reward-based-crowdfunding-keep-it-all-vs-all-or-nothing-16755/

No token or token has expired.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home1/silvege7/public_html/paradigmconsultant.com/wp-includes/formatting.php on line 4371